Introduction

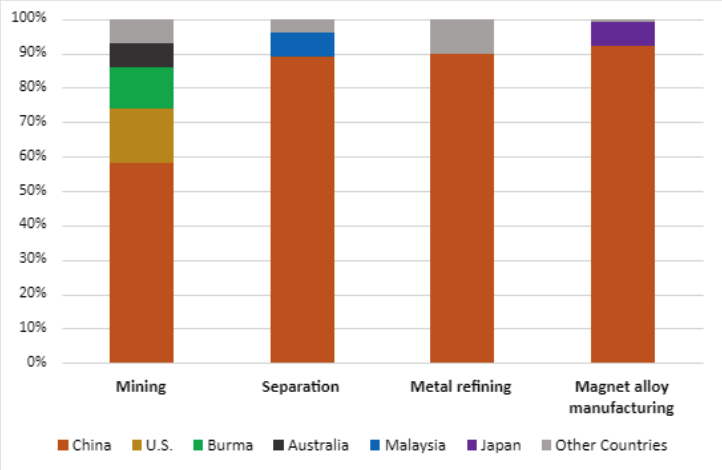

Emerging technologies from AI accelerators to advanced batteries rely on critical minerals. With few exceptions, the U.S. is a net importer of processed critical minerals that feed into emerging technologies. While extraction of mineral feedstock (ores, concentrates) occurs around the world, and the U.S. is in fact a net exporter of rare earth mineral concentrates, the vast majority of the mineral separation, refining, and alloy manufacturing is concentrated in Asia, and China specifically (Figure 1). In particular, Chinese firms supply 90% of the rare earth permanent magnets used in everything from EV motors to F-35 jets (which contain 920lbs of rare earths each, according to one estimate).

Figure 1. Geographic concentration of supply chain stages for sintered NdFeB magnets (USITC)

Chinese leadership in these supply chains is a function of genuine innovation, price manipulation, and subsidies. For example, the world has known how to make high purity Gallium (a byproduct of aluminum production) for decades. The reason China controls the market for high purity Gallium is that PRC firms can compete on technical ability with international peers and additionally get government subsidies and other support such that they can outcompete international suppliers on price, effectively pushing their competition out of business. There is simply nowhere in the world that can compete with Chinese production on a levelized cost of production per kilogram basis for most critical minerals.

A tremendous amount has been written about these vulnerabilities and what the U.S. can (and can not) do about it. These vulnerabilities are all the more relevant following China’s April 2025 export controls on a variety of rare earth elements and subsequent worldwide shortages, leading South Korean firms to renege on sales of transformers containing these magnets to U.S. military-affiliated end users and Ford to temporarily idle factory operations. While these shortages may cause economic harm today, shortages of this nature in a future wartime scenario are a clear national security vulnerability.

This article proposes a short term technical solution to this problem in a future wartime scenario: a U.S. government-led Salvage for Technology campaign that collects and recycles electronic waste (“e-waste”) to recover critical minerals and materials. E-waste is dense with critical minerals and materials, the U.S. already collects millions of dollars of e-waste containing tons of minerals annually, and various technologies to recover these resources exist. However, the vast majority of U.S. e-waste is currently exported to Asia because the U.S. has underinvested in (1) e-waste recycling programs (2) e-waste extraction technology and (3) recycled critical mineral processing at scale. All of this is because critical minerals derived from e-waste are an order of magnitude more expensive to produce than critical minerals derived from raw feedstock. But in a future conflict, time is of the essence and national security needs are price insensitive.

This proposal suggests a volunteer led and managed program to collect and consolidate e-waste from private citizens, where it will then be taken to sorting centers and sold to e-waste recyclers managed by private firms using facilities built and equipped using USG/DOD subsidies. From there, the alloys can be processed and sold as usable product across the defense industrial base to address material shortages.

How We Got Here

Chinese firm leadership in this market is a function of business advantages (lax permitting, low labor costs, government incentives), market manipulation, savvy dealmaking, and genuine innovation. Most critical mineral markets (and especially rare earth element markets) have opaque pricing, lack liquidity, and are spot-driven. Because prices operate based upon near-real time supply and demand signals, they are susceptible to huge swings not normally seen in exchange-traded commodities. Chinese suppliers of rare earth products have masterfully manipulated supply and pricing in the last 30 years, all while driving erstwhile competitors in the U.S. and Europe out of the market. Chinese firms have also locked in feedstock suppliers worldwide through long term offtake agreements and invested in processing of minerals with high codependence/coproduction, making for multiple profitable revenue streams (ex. recovering high concentrations of Gallium via the production of alumina from mined bauxite).

Since at least 2002, the U.S. government has been content to write reports warning of this situation while doing nothing substantive to address it. The private sector has heard these warnings, ignored them, and willingly built their supply chains around Chinese vendors so long as cost, schedule, and performance remained steady. DOD claims it has awarded more than $439 million to establish domestic rare earth element supply chains since 2020, with basically nothing to show for it. DOE’s efforts appear similarly feckless. Its Critical Materials Innovation Hub has received hundreds of millions in funding since 2013 and DOE has offered billions in loans and grants for critical mineral production over the same period, and we still find ourselves beholden to Chinese suppliers today. A Sisyphean cycle has emerged: in seemingly every NDAA Congress requires DOD, DOE, and/or USGS to write a strategy (ex. p. 6 here) for breaking China’s monopoly and these agencies paper over the problem with reports and piecemeal solutions.

Proposed Solutions

Short term solutions frequently cited include trade diversion via third-party countries to get around Chinese controls, increasing stockpiles or establishing new ones, and funding domestic production sufficient for life of program buys. These solutions are like putting band-aids over bullet holes. More ambitious supply-side proposals suggest the U.S. government step in to offer tax credits and financial incentives which, combined with permitting reform and up-front offtake agreements that set a price floor, would make it economically feasible to begin new mining, refining, and processing projects domestically. The Administration’s recent Executive Order on Undersea Mining has also generated enthusiasm that a new supply of critical mineral-dense nodules from the seabed might appear in the coming years.

In the longer term, three types of technical solutions are generally proposed:

-

Enhancing and diversifying supply: expand the supply of rare-earth and other critical resources through innovative processes and finding new uses for co-products. This mainly involves the development of new REE processing IP (most of which is currently owned by Japanese and Chinese firms) and finding cost competitive ways of processing REEs and markets for the byproducts of that processing.

-

Developing substitutes: development of alternative magnet materials that can meet the needs of current and emerging energy technologies. This mainly involves development of rare-earth-lite or rare-earth-free permanent magnets that simply cut Chinese firms out of these supply chains.

-

Unlocking secondary sources: critical materials recycling and waste valorization.

All of these solutions come with significant tradeoffs and uncertainties: even the best prepared companies maintain one year stockpiles at most and DLA’s annual acquisitions plans don’t suggest their strategic materials stockpile could sustain intensive drawdowns by DOD in a wartime scenario. Opening a new mine takes a decade on average, and government offtake agreements providing price floors are unprecedented and likely as politically unpalatable as tax credits for strip mining. Undersea mining technology is TRL 4 at best and the entire supply chain of ship to land transport and processing infrastructure doesn’t exist. In addition, those theoretical ships would need to be Jones Act compliant, guaranteeing they cost hundreds of millions more than they need to, and arrive too late to be relevant. Each of the technical solutions above is viable, but lacks scale and urgency.

Proposal

We propose the U.S. government lead a Salvage for Technology campaign that collects and recycles electronic waste (“e-waste”) to recover critical minerals and materials. E-waste is dense with critical minerals and materials, the U.S. already collects millions of dollars of e-waste containing tons of minerals annually, and various technologies to recover these resources exist. However, the vast majority of U.S. e-waste is currently exported to Asia because the U.S. recyclers cannot compete on price.

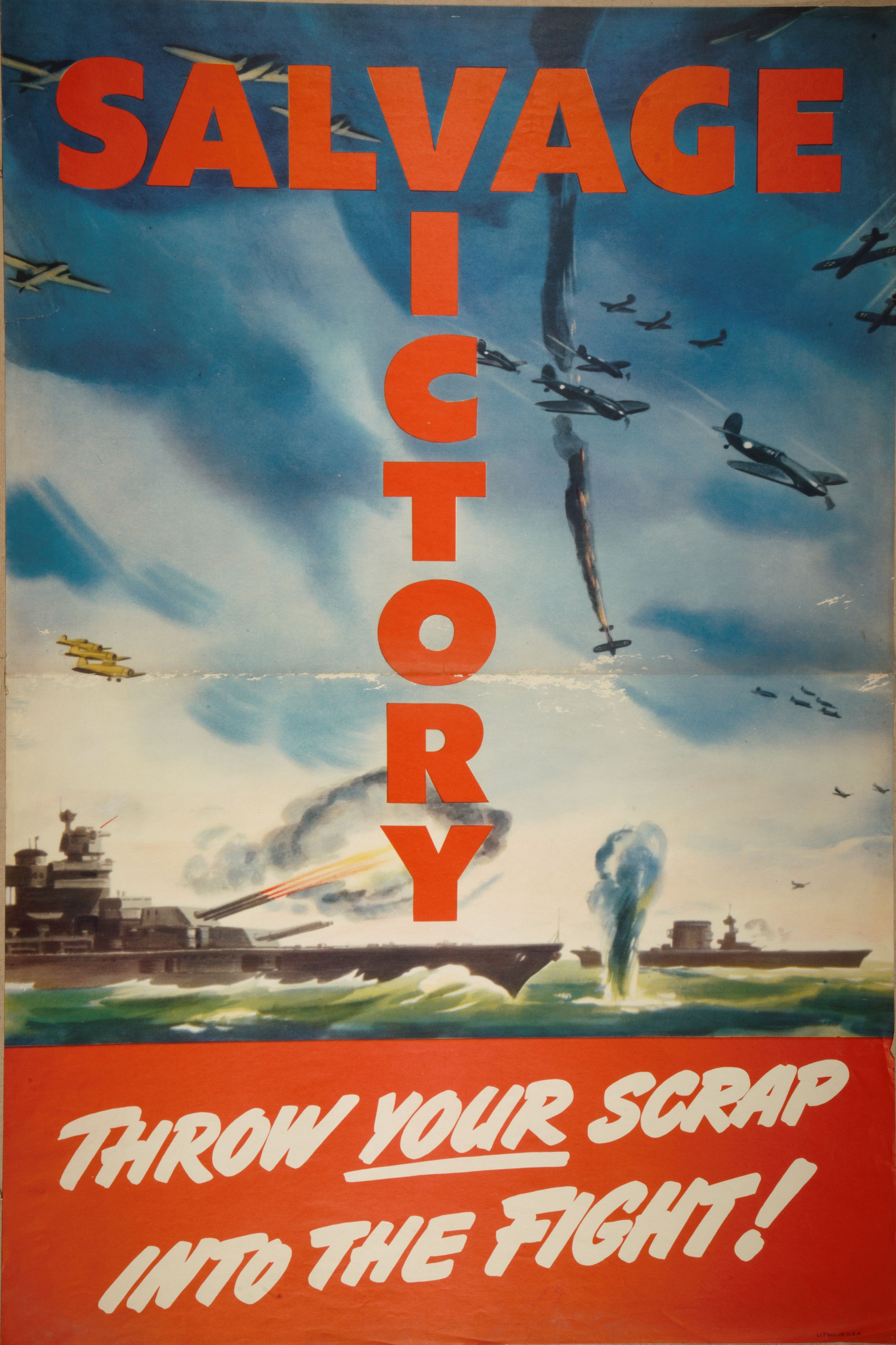

Faced with similar shortages of domestically-produced raw materials as manufacturing scaled-up during World War II, the United States government’ War Production Board instituted a Salvage for Victory program to recycle steel, copper, aluminum, brass, and other materials. Community volunteers collected waste and scrap through civic drives around the country where it was then organized by Boy Scout troops and volunteers at local sites. These collection drives were structured as competitions and once sorted, materials were turned over to industry for processing in steel mills, rubber factories, paper mills and foundries. The government’s role was primarily to act as a facilitator: generating enthusiasm for collection and sorting and subsequently ensuring the refined products reached the necessary industrial end user. In addition to being economically efficient, it had a socially unifying effect during the war.

Source: Library of Congress and Bangor Public Library

This 20th century solution is just as relevant to our current 21st century situation. Leveraging DPA authorities, the U.S. government could partner with industry to establish and scale an e-waste recycling ecosystem that provides sustained supplies of domestic critical minerals and in fact corners a neglected part of this global market.

The U.S. produces 10-20% of the world’s e-waste in any given year, the vast majority of which is exported overseas and sometimes re-enters the U.S. as counterfeit electronics. Of this waste, research suggests roughly 1.8 metric tons of REE magnets could be recovered. The technologies for REE recovery from e-waste are all TRL 4-6 or higher in some cases, and various pathways are optimized for handling different types of e-waste from hard drives to solar panels. Hydrometallurgy, electrical dissolution, and biosorption all have reported REE e-waste recovery rates of >99.5%. All of these numbers have room for vast improvement if a concerted national collection campaign is organized.

Remarkably, only 1-2% of REEs produced globally are recovered through recycling processes, indicating the total addressable market for secondary source REEs remains basically untapped. In addition to separation costs being higher in the U.S., technological separation for smaller forms of e-waste, insufficient infrastructure for large-scale e-waste collection, and lack of regulatory incentives all are holding back the U.S.

Importantly, this Salvage for Victory opportunity is not limited to REEs. Forthcoming research from LBNL highlights the promise of recycling Gallium too, another element subject to PRC export controls that generate headlines. This research shows that it is basically twice as expensive to produce Gallium in the U.S. ($300-$420/kg, depending on the process used) from raw feedstock as it is to do so in China. However, in an emergency scenario, waiting to establish a mine to get this feedstock is not realistic. This research also found about 10.5 T of Gallium reached end of life in the U.S. in 2023 in the form of phones, laptops, solar cells, and lighting but, because there are zero gallium recycling facilities in the U.S., it just ended up in landfills. Separate research (now slightly dated) found that recovering Gallium from recycled solar cells resulted in a levelized cost of production/kg of $3,400.

While these costs are clearly too high a price to be competitive in normal times, in a conflict when material availability is more important than price, the U.S. would be well-served to invest in the recovery technology. Critical mineral security is going to require policymakers to accept more risk than they’ve historically tolerated, apply more focus (larger amounts of patient capital) than DOD or DOE has to date, and think creatively about where existing authorities like DPA Title I and Title III can help and where new authorities (to negotiate offtake agreements, for example) are needed.